Chipping Away At China’s AI

The new controls have been a boon for China’s domestic chip industry by making it a magnet for talent, money and attention but this leaves Chinese AI companies out in the cold, especially startups.

Losing out on AI will be a national strategic failure for a great power. Technological phase changes are opportunities for ascending entities to overtake established ones, AI is one such example. In this analysis we describe how the new export controls effect the dynamic of technology competition. While the new controls have been a boon for China’s domestic chip industry by making it a magnet for talent, money and attention this leaves Chinese AI companies out in the cold, especially start ups.

This newsletter is a labor of love but these reports take a lot of work to put together, so please consider supporting my work by signing up for a paid subscription!

Also, I am open to consulting and research services, so please reach out to nick.zeniou@zenontech.co if you have any enquiries.

The full report is available to download at the link below for free.

No design arounds in new restrictions

The new October 2023 export controls are tighter for AI chips and semiconductor equipment going into China by 1) closing technical loopholes to only allow 5-year-old GPUs, over 10x less powerful than the leading edge and 2) to control exports to additional ‘countries of concern’ akin to arms controls. It will be unlikely that Nvidia can design around the new controls in a meaningful way. Huawei’s best GPU already exceeds the limitations of the restrictions, so fabricating this chip locally will be China’s best option, alongside older Nvidia chips to meet local demand.

For a deeper analysis of this topic, refer to our previous post here (Arms Controls for Advanced AI Chips)

US is well ahead in AI

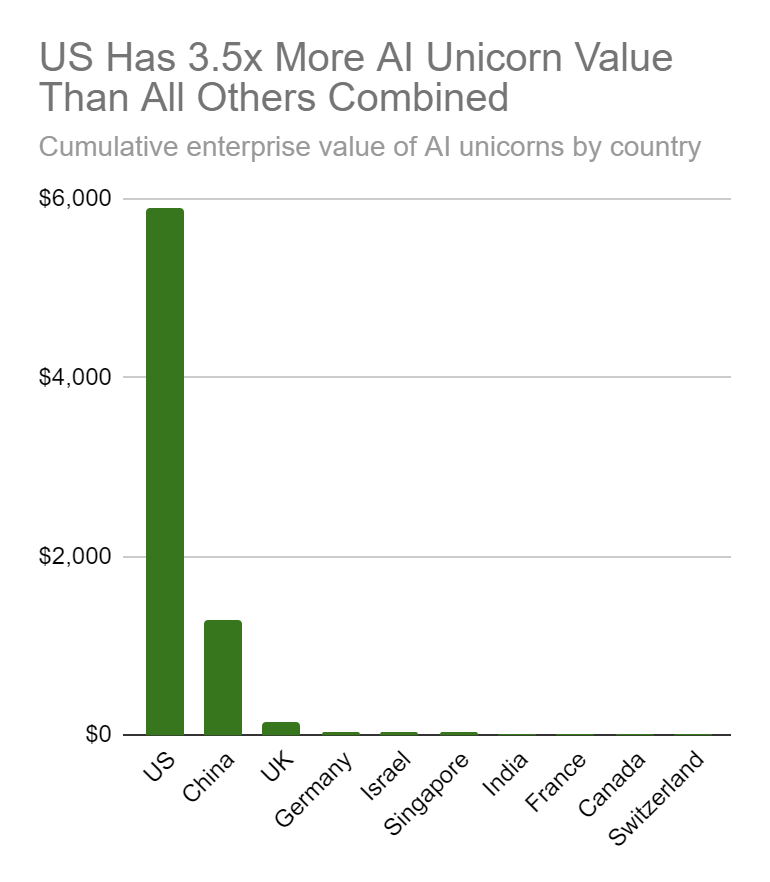

The US currently has a multi-year lead on China in AI owing to starting earlier, more VC investments, depth of talent and AI hardware advantages. Entities in the US publish 70% of the most cited AI papers, and US AI unicorns hold almost 80% of the total enterprise value of AI unicorns globally.

For a deeper analysis of this topic, refer to our previous post here (AI Technology Too Important to Lose)

The Chip Choke strategy has morphed into a Mow the Grass strategy

Large platforms like the entire industrial base of a powerful country are adaptive and resistant to narrow strategic targeting. The ‘Chip Choke’ strategy initiated by President Trump has morphed into a ‘Mow the Grass’ strategy, which cuts off threatening or high value targets. This has the unintended consequences forcing Chinese innovation in chip manufacturing; however, it also diverts China’s resources into catching up. China, which once aimed for complete technological dominance, now finds itself having to selectively focus on key technologies.

Too early to say the restrictions have failed. China chips boom while AI suffers

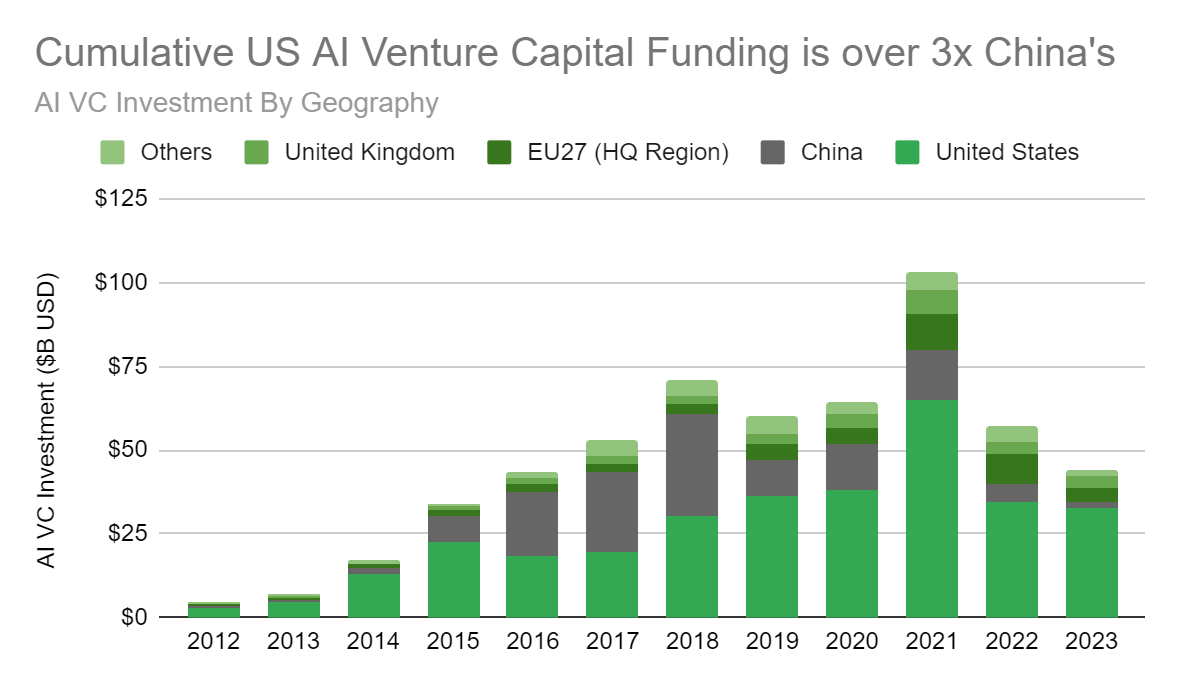

While China’s Hyperscalers have managed through restrictions with scale and inventory, AI startups have floundered. Up to 80% of raised capital for an AI startup can go into compute resources, and without access to American chips, AI VC in China has become suicidal. China AI VC has shrunk over 90% from its peak of $30B in 2018 down to $2B in 2023, while the US peaked at $120B in 2021 and is down to $50B in 2023.

For a deeper analysis of this topic, refer to our previous post here (China Tech Ban Defensive Tactics)

Beijing’s policies that hinder China’s tech sector are a feature of Chinese policy making, not a bug

While China had ambitions to be a world leader in tech, it seems they have recalibrated their approach to prioritize domestic stability and preservation of culture.

“I think among the richest men in China, few have good endings.” Jack Ma

Panic buying of chip making equipment will support Q3 earnings of equipment suppliers

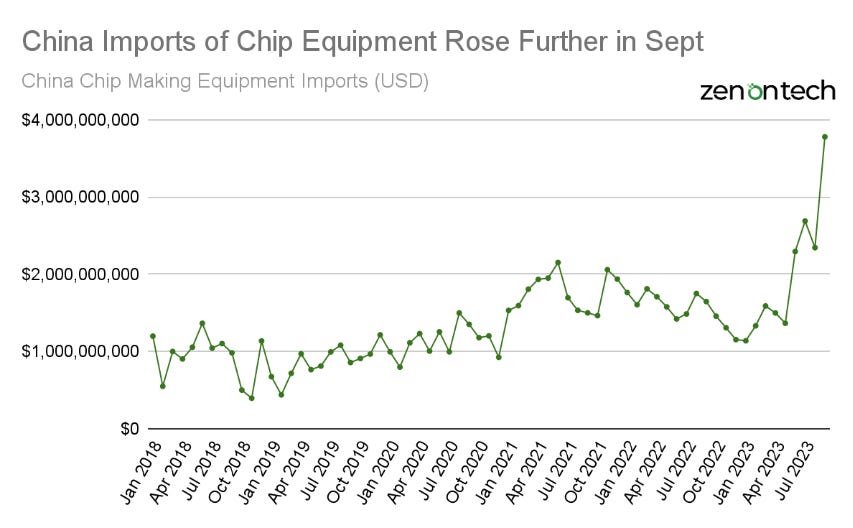

Chinese imports of chip-making equipment rose from $1.5M in April, to $4M by September. This sudden spike will boost business for chip capex companies in the US, Japan, and the Netherlands.

Cloud services are an important leverage point to keep open to China

Washington is contemplating restricting Beijing's access to cloud computing services offered by American enterprises. However, reliance on U.S. cloud services provides the strategic option to disrupt Chinese companies’ operations instantaneously. Chinese IT and AI firms that leverage U.S. cloud services using the most high-end GPUs (unavailable in China) might gain a competitive edge over their domestic counterparts. In that situation, it could be in Beijing’s interests to promoting domestic cloud infrastructure and services. Relying on foreign cloud providers poses not just technological, but also strategic risks for China.