US Supply Chain Scrutiny and Asian Chip NATO

The US is embarking on an expansion of supply chain regulation not seen for decades. The 100-day supply chain review from the Biden administration put a heavy focus on semiconductors. We can expect increased investment in US-based materials production, chip fabrication and advanced packaging. The globally distributed and geographically specialised chip supply chain emerged as a function of efficiency but, the global drive for self-sufficiency will reduce capital efficiency. This change will benefit semiconductor equipment makers.

There are, however, execution challenges to US industrial policy. Reports highlight that while the supply chain review provides policy recommendations, it does not include a feasibility study. There is a range of potential unintended consequences, such as aligning Chinese companies in a drive to replace US suppliers. US companies will also incur costs in complying with complex administrative procedures, leading to lost opportunities. Moving toward a government-driven approach won’t be a straightforward task for the US. However, the US military-industrial complex is moving forward with a period of experimentation to find the right balance of centralised industrial control.

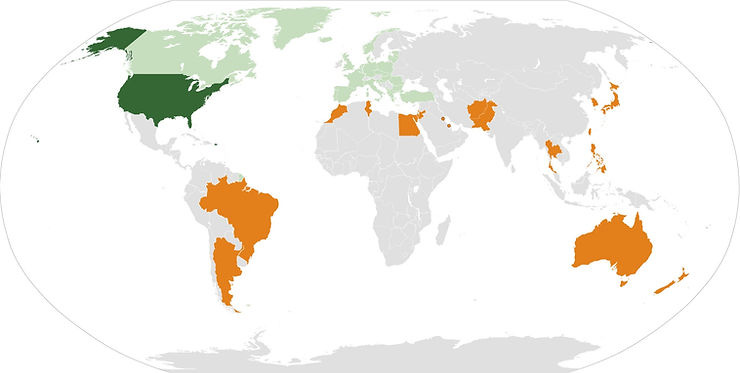

With the bifurcation of the supply chain, executives in the chip industry have indicated they aim to straddle both the US and Chinese ecosystems as long as possible. Governments, however, are looking to work with allies and partners to solidify their supply chain networks. The 100-day supply chain review points to the Quad and G7 as vehicles for improving security. Further, NATO is turning to Asia to increase its trusted science and technology partnerships, with Japan recently joining the fold. Taiwan has historically been excluded from international organisations at the behest of China. However, with the Quad, G7 and NATO strengthening partnerships for supply chain security and Taiwan at the centre of the chip supply chain, the status quo may be up for review.

With supply chains closing off around them and decreasing cooperation from the science and technology leaders of the world, Beijing has decreasing options. Under the squeeze of international sanctions, Chinese firms are working together to create trusted supply chains but, progress is slow. In the meantime, China has limited options to retaliate without inflicting significant damage on their industry. China has commanding shares in rare earth and outsourced chip assembly and, cutting off supply would disrupt the foreign chip supply chain. But, they are relatively low tech sectors and, Western firms are already replacing Chinese capacity. There is an imbalance of power between the Chinese and the US chip ecosystems. The US has commanding influence over equipment and design software, which could take a decade for China to replicate. But still, Beijing can continue to frustrate M&A deals and deny market access to replaceable US suppliers.