Shifting Sands: Middle East Conflicts and Global Trade

The Red Sea Shipping crisis adds downward price pressure to Chinese manufacturers. Violence in northern Syria and Iraq spikes, while the Lebanon-Israel border is the most volatile hotspot.

With an upcoming trip to the Middle East, I've been examining the region's security dynamics. This exploration is crucial for understanding the factors that influence this region which has so much growth potential and yet is trapped in regional conflict. In this article, I highlight the interplay of simmering conflicts in the Middle East. This post is focused on the current situation, in future posts we’ll look into other overarching dynamics of the region.

The Red Sea shipping crisis is having huge repercussions on global trade, particularly affecting China's freight to the EU. China's economic challenges, compounded by underutilization of factories, have led Beijing to subsidize exports, potentially supporting deflation in developed markets. The US's reduced strategic focus on the Middle East, contrasts with China's continued reliance on the region for energy.

While the focus on Israel and Gaza has intensified, leading to a concentration of violence there, the broader region, especially the economically developed Arab states, has remained relatively stable. However, the frequency of violent events has doubled in some regions of northern Syria and Iraq. These areas have become more volatile, potentially due to the diversion of media attention towards the Gaza conflict, granting parties involved more freedom to operate. It is crucial to closely monitor these dynamics, as well as events on the Lebanon border with Israel as shifts in any of these areas could significantly impact the region's stability and security.

Shipping Crisis is Deflationary for Manufacturers

The Red Sea shipping crisis, has had far-reaching impacts on global trade. The crisis has led to significant disruptions in shipping routes, causing delays in freight movement from key manufacturing hubs. This situation has resulted in prolonged transit times and increased freight costs, to the detriment of supply chain efficiency and reliability.

The world is dependent on US naval power and diplomatic engagements with Iran to defuse tensions and ensure the safety of shipping lanes. While Beijing has made a backdoor deal with Tehran to avoid Chinese vessels getting attacked, escalated shipping costs have impacting trade flow, particularly between China and the European Union.

"China calls on all parties concerned to remain calm and restrained, adhere to dialogue and consultation, promote a political solution, refrain from any acts that aggravate the situation, and do their best to maintain the positive momentum of the political process in Yemen," He reiterated his call for de-escalation "to ensure safety of our seafarers, freedom of navigation and stability of supply chains".

Geng Shuang, China's deputy permanent representative to the UN. China Daily

Macroeconomics: Shifts in Global Investment and Trade

China's economic landscape is currently navigating turbulent waters, marked by a confluence of internal challenges. Compounding China’s economic issues are a significant underutilization of its manufacturing capacity. In response to these domestic economic strains, China has initiated a strategy of export subsidization. This approach, might inadvertently exert deflationary pressures on developed markets, contributing to the mix of inflationary and deflationary trends.

The impact of the Red Sea shipping crisis has been particularly pronounced on China and its manufacturing sector. Research from Morgan Stanley highlights that rates for shipping from China to the US have increase by 18%, whereas those to the EU have surged by over 60% since the crisis began. This sharp increase in shipping costs is placing a downward pressure on Chinese manufacturers, while increasing the costs of goods in the European.

These developments are adding fuel to the fire for two major trends: firstly, the ongoing underutilization and resulting deflationary pressures within the Chinese manufacturing sector; and secondly, a declining inclination towards investment in Chinese manufacturing.

FDI Shifts: China's Challenge, US Gain

The current global economic landscape, marked by the ongoing US-China trade war initiated in 2018 and recent geopolitical developments, has significant implications for China's manufacturing sector. China's increasingly complex international relations, especially its alignment with Russia and the tensions over Taiwan, have contributed to a perception of investment risk in the country. This perception has been compounded by internal factors, including the government's response to the COVID-19 outbreak and Xi Jinping's extensive anti-corruption drive targeting high-profile political and business figures.

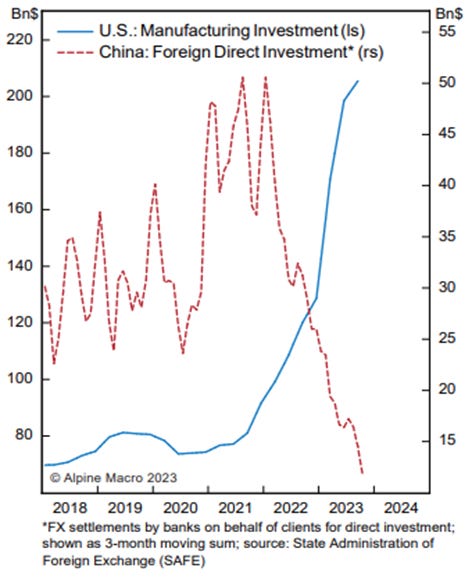

China is still a middle income economy that requires FDI to progress along the technological curve. As such, the "investors' riot" of 2023 has to be reversed, or else China may find itself stuck in the dreaded middle income trap. Chart below is quite telling. Marko Papic, Chief Strategist Clocktower group

These factors have collectively influenced a notable shift in foreign direct investment (FDI), diverting it from China to other developing markets and domestically in the United States. Conversely, the US and its allies have witnessed a surge in manufacturing investment. This shift reflects risk aversion towards China and a strategic pivot by investors towards more stable and predictable markets.

This FDI divergence has broad implications. For China, it threatens its growth model reliant on foreign capital for technological advancement. The US, however, could leverage domestic investment to mitigate inflationary pressures in global trade and support economic growth.

Underutilization of Chinese Factories

China's manufacturing industry, particularly its automotive sector is operating at only 59% capacity. In response, the Chinese government implemented export subsidies in the second half of 2023 to maintain factory operations, a move that will contribute to deflationary pressures in global markets. This situation presents a complex interplay of economic forces. While China's subsidization efforts aim to sustain its manufacturing output, they also have the potential to exert downward pressure on goods prices. This dynamic could offset the impact off logistics crises by supporting Chinese factories to lower pricing while reducing it impact for consumers in the EU.

Microeconomics: Higher Inventory and Worse Cashflow

On a microeconomic level, the crisis has led to increased freight costs, prompting importers to negotiate lower prices from Chinese suppliers and adjust prices for end-users in markets like Europe. The resulting scenario is a unique juxtaposition of deflation in China and inflation in Europe, on top of part shortages for EU manufacturers.

Now that freight prices are increasing, importers from China are doing 2 things: 1) asking Chinese suppliers more discounts (5 to 7%) 2) slowly increasing prices to end users You see where we are going? Deflation in China, inflation in Europe. Marco Castillo, X

Microeconomic Case Study

This case study focuses on the microeconomic impact caused by a month-long delay in a shipment from China. Originally due for delivery in early January, it's now expected in early February, attributed to disruptions in the Red Sea shipping routes.

For the European Customer:

Initial Scenario: 30-day inventory costing $100,000.

Post-Delay Scenario: Inventory extended to 60 days, doubling the cost to $200,000.

Additional Financial Burden: The delay necessitates an extra $100,000 in capital to maintain the inventory.

For the Chinese Factory:

Expected Payment: $100,000 post 30 days of delivery.

Effect of Delay: Same amount, but delayed by an additional 30 days, leading to a cash flow gap.

Financial Strain: Factory needs to manage its debts and cash flow for an extended period without expected revenue.

Should such shipping delays become a regular occurrence, both parties - the customer and the factory - would need to recalibrate their supply chain strategies. This may involve exploring alternative shipping methods, revising inventory management practices, and enhancing liquidity management strategies to adapt to longer transit times. While an initial adjustment phase of about 5-6 months could stabilize the supply chains, the ongoing challenges of increased capital requirements and extended cash flow gaps could continue to exert pressure on the financial health of both EU importers and Chinese exporters.

Air Strikes on Houthi’s are a Media Band-Aid

The recent U.S. and British air strikes against Houthi forces in Yemen, while a significant response to months of attacks on Red Sea shipping, won’t bring meaningful relief. President Biden emphasized, the intent is to demonstrate a firm stance against threats to global navigation and personnel.

Targeted military attacks are inherent limited against a determined adversary. While the Pentagon reports a notable impact on the Houthis' operational capacities, these strikes are unlikely to offer a resolution to the underlying regional conflicts. They serve as a symptomatic treatment, without necessarily altering the broader geopolitical dynamics that fuel such hostilities. The crisis in the Red Sea region predominantly affects European and Chinese interests, and the US lobbing a few missiles into Yemen is a rather low effort means of looking busy.

China Depends on Middle East More Than US

The United States attained energy independence around 2019, marking a significant transition from its peak energy dependence in 2005. This development has contributed to a reduced strategic emphasis on the Middle East, with the U.S. instead concentrating on the escalating competition with China (see excerpt from the National Security Strategy below).

Support De-Escalation and Integration in the Middle East

Over the past two decades, U.S. foreign policy has focused predominantly on threats emanating from the Middle East and North Africa. We have too often defaulted to military-centric policies underpinned by an unrealistic faith in force and regime change to deliver sustainable outcomes, while failing to adequately account for opportunity costs to competing global priorities or unintended consequences. It is time to eschew grand designs in favor of more practical steps that can advance U.S. interests and help regional partners lay the foundation for greater stability, prosperity, and opportunity for the people of the Middle East and for the American people. October 2022, National Security Strategy

The Red Sea crisis, primarily affects trade between China and the European Union. Additionally, nearly half of China's oil imports originate from the Middle East, highlighting Beijing's reliance on the region for its energy needs. While the Middle East is no longer critically vital to American energy interests, it is a means of applying pressure to global markets. China doesn’t have the military power to safeguard its interests in the Middle East so it relies heavily on diplomatic efforts, with the ongoing crises likely causing considerable concern in Beijing.

Conflict Data: Currently Contained, Possibility of Regional Disruption

The outbreak of violence in Israel and Gaza in October has not only heightened tensions in these areas but also influenced the broader regional conflict dynamics. This analysis delves into the current trends across different Middle Eastern countries, highlighting the complexity and varying nature of these conflicts.

Israel, Palestine, and Lebanon: Escalation Risks

The escalation of the Israel-Gaza conflict has significantly increased violent incidents within Israel, the Palestinian territories, and Southern Lebanon, with Gaza emerging as a central focus of military engagements. This situation indicates a potential for the conflict to spread regionally, especially given Lebanon's proximity to Israel and the involvement of Hezbollah.

Israel, facing this heightened tension, has conveyed to Washington that without a long-term border agreement with Lebanon, it might escalate military actions against Hezbollah. Lior Haiat, an Israeli foreign ministry spokesman, emphasized Israel's preference for a diplomatic solution but did not rule out independent action if necessary: "If a diplomatic solution will not be possible, we will have to act on our own.”

Despite Hezbollah's receptiveness to diplomatic discussions, their commitment to rocket attacks in support of Gaza persists. A senior Lebanese official familiar with Hezbollah's thinking stated to Reuters, "Hezbollah is ready to listen," while noting their rejection of U.S. negotiated proposals. The situation remains precarious as diplomatic efforts continue amidst a backdrop of military readiness and regional instability.

Israel is demanding that Hezbollah retreat north of the Litani River in Lebanon to create a security buffer for northern Israeli citizens. Hezbollah will refuse. At that point the war will probably spread. Iran will support Hezbollah, increasing conflict throughout Syria and Iraq where supply lines run.

Neither the U.S. nor Israel has fully accepted a world in which a nuclear-armed Iran, backed by Russia and China, manages to dominate the region. But if the U.S. looks to force Israel to accept that world, then Israel may refuse to accept Hezbollah looming over it at the same time.

In other words, the U.S. is demanding that Israel refrain from confronting Iran directly. But Israel will interpret this demand as permission to attack Hezbollah. Matt Gertken, BCA

GCC and Stable Countries Stay Stable

Contrary to historical patterns, especially following past conflicts with the Houthis in Yemen, the economically developed Arab states, including Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Oman, and Bahrain, have experienced a period of stability. Egypt, Jordan and Turkey are also experiencing no increases in violent events. This stability is significant, given the region's history of conflict spillover following major disturbances. The current absence of escalation in these states is a positive sign, indicating effective governance and diplomatic measures in maintaining internal and regional peace.

“Saudi Arabia has had one objective, which is to prevent this from escalating into a wider regional war,” said Tobias Borck, an expert on Middle East security at the Royal United Services Institute. “It has attempted over the last few years to bring its intervention in the war in Yemen to a close, including through negotiations with the Houthis and actually from all we know from the outside, [they] are reasonably close to an agreement.” POLITICO

Less Violence in Yemen and Iran

Conversely, Yemen and Iran demonstrate a different trajectory. Despite Yemen’s historical role as a focal point for regional conflicts, there has been a decrease in violent events. This reduction indicates regional militant efforts have been redirected to the Israel-Gaza area. However, violence in Yemen will undoubtably increase with incoming G7 attacks.

Increased Attacks in Syria are Opportunistic, not Escalatory

The ongoing conflict in Syria, which has ravaged the country since 2011, has escalated since the October attacks. The Asad regime, with the backing of Russian forces, is exploiting the current distractions caused by the Israel-Hamas war to intensify their military operations against opposition-held territories in northwest Syria. This tactic allows them to conduct increasingly indiscriminate attacks with less international scrutiny and condemnation. Notably, violence in the Damascus region, and near the Israeli border has not increased.

Less Discriminate Targeting of Opposition-Held Areas

Northwest Syria, particularly the Idlib province, remains the last significant stronghold of opposition forces. The Syrian government, is intensifying its efforts to root out opposition elements from this region. Recent artillery and air strikes have led to a surge in civilian casualties. Since the escalation of attacks in early October, the number of violent events in the Idleb and Aleppo regions has doubled on a per week basis.

The Asad regime and Russia's military strategy in northwest Syria, under the cover of the Israel-Hamas conflict, represents a concerning development in the Syrian crisis. However, this appears to be opportunistic attacking rather that an escalation of regional conflict.

Conflict in Iraq Contained to Kurdish-Turkish Region

Iraq presents a complex scenario where overall conflict levels have slightly increased, but regional disparities are evident. Baghdad, historically a center of unrest, has seen a noticeable reduction in violent incidents. In contrast, Northern Iraq, particularly the regions around Erbil and Duhok, are experiencing a 50% increase in the frequency of violent events.

This increase in Northern Iraq is predominantly driven by tensions between Turkish military forces and Kurdish factions, including the PKK. The conflict here is increasingly drawing in regional players and could potentially have broader implications for the stability of the local region.

Suppression of Kurds

As an ethnic minority striving for statehood, Kurdish groups have historically shown solidarity with Israel and a friendly stance towards the United States. This alignment and Kurdish militant separatist movements has often led to local opposition. In 2022, the Central Iraqi government passed legislation making normalization of relations with Israel illegal. This law restricts the semi-autonomous Kurdish region in Northern Iraq from forging diplomatic ties with Israel.

The Kurdish areas in northeastern Syria and northern Iraq are facing a complex and escalating conflict. The intensifying clashes between Kurdish groups, particularly the PKK, and Turkish military incursions represent a critical risk. The Iraqi government has struggled to prevent Turkish military incursions into its territory. In the backdrop of a semi-autonomous Kurdish government in Northern Iraq and the establishment of a self-governing Kurdish region in Syria, Turkey is aggressively acting against Kurdish insurgent groups. This aggressive stance stems from Turkey's concerns about potential territorial claims or separatist movements within its southeastern borders, prompting a forceful response to suppress Kurdish rebellions. This situation, is tangentially related to the Israel-Gaza conflict, and could see increased fighting due to the distraction created by the conflict in the Levant.

Less Attacks on US bases in Iraq After Withdrawal

Since mid-2019, Iran-backed militias in Iraq have targeted U.S. bases and convoys. These militias have strategically varied their attacks, balancing between exerting pressure and avoiding heavy retaliation. Following the reduction of U.S. troops in December 2021, their focus has shifted to other targets, including secular establishments and Turkish forces.

While the violence in Iraq has significantly reduced, the Iraqi government faces significant challenges in establishing its central security authority. There are several semi-legitimate militia groups, some of which are backed by external actors like Iran. These militias often play a prominent role in Iraq's security landscape. Furthermore, external powers such as Turkey, Iran, and the United States operate within Iraqi territory with limited intervention from Baghdad. Recent weeks have seen all three foreign nations conducting airstrikes on targets within Iraq. Despite these actions, the Iraqi government's responses have been largely limited to calls for cessation, highlighting limitations of its control over foreign intervention and national security. These events involving foreign powers in Iraq and Syria have been limited to a handful of cases. While they create headlines and stoke frustrations, they aren’t yet moving the needle on net violence.

Prospects and Risks

Overall, the current conflict trends in the Middle East exhibit a peculiar balance. While the focus on Israel and Gaza has intensified, leading to a concentration of activities there, the broader region, especially the economically developed Arab states, has remained relatively stable. However, the ongoing Kurdish conflicts in northern Iraq and northeastern Syria emerge as wildcards that could disrupt this balance. It is crucial to closely monitor these dynamics, as shifts in any of these areas could significantly impact the region's stability and security.