Semiconductor Shock, Rationing and Escalation

Pandemic related lockdowns have driven global demand for consumer electronics through the roof as people stock up on home office and entertainment supplies. This unanticipated explosion in demand has left the consumer electronics supply chain scrambling to keep up. Semiconductor foundries have orders backed up through 2021. As a consequence, automotive companies have been forced to cut production output and shut factories. The chip shortage is spreading to all consumers of chips for computers, mobile and gaming devices. Government officials in Germany and the US have been lobbying the Taiwanese government to help secure supply to minimise economic damage. TSMC has been working to ensure their automotive customers aren’t hung out to dry.

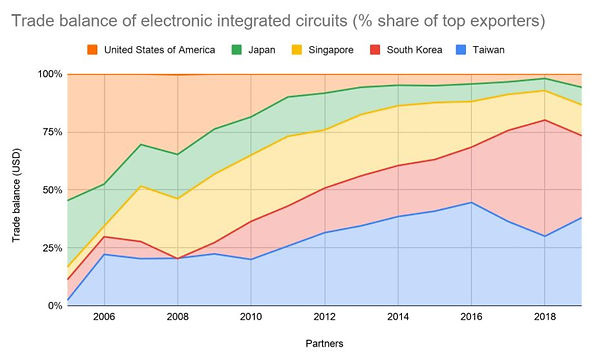

China's largest import is foreign manufactured IC’s and China doesn’t have a clear path to supply its own IC needs in the foreseeable future. Intel is the last CPU integrated device manufacturer (IDM) in the US and has been missing key development milestones and is being outpaced by TSMC and Samsung. Business for Taiwan Semiconductor has been booming. In Q4 2020, TSMC accounted for 56% of global chip manufacturing revenue. This is a particular risk given the historical and present geopolitical risk of China seeking to unify with Taiwan as well as the erosion of US semiconductor manufacturing.

Oil supply and demand shocks in the 1970s and 80s made the geopolitical importance of oil painfully clear. Supply shortages forced countries to take extreme measures. Governments were driven to reduce their dependence on foreign powers for oil supply while authoritarian regimes sought to control and weaponise it. Semiconductors have overtaken oil as the largest import or export for modern economies, as has their geopolitical importance.

As an IC exporter, Taiwan is being forced to choose who to sell chips to amidst the shortage. TSMC has signalled it will prioritise orders from “like-minded” democracies. The US is currently the main barrier standing between Taiwan and their mainland oppressor so it follows that US companies get prioritised. Chinese companies may be among the most starved of chips, Beijing could interpret this as an escalation of the technology blockage and react in kind. This already seems to be playing out with the Chinese Ministry of Industry and Information Technology drafting controls on the export of rare earth minerals from China to the US.

There are many potential pathways an escalation could take. The PRC has had their sights on conquering Taiwan ever since the end of the civil war in 1950. The most recent Taiwan crisis during their first democratic election was a troubling moment. The consensus in the CCP seems to be that the US is experiencing a steady, irreversible structural decline which could justify aggressive actions. With dwindling supplies of semiconductors in China and increasing military tensions in the Taiwan strait, the potential for a Chinese invasion of Taiwan should be considered.