Saudi Arabia's Risky Path to Modernization

Saudi Arabia's future looks promising under Vision 2030. But while Saudi-Iran rapprochement reduces security issues, proxy conflict and the specter of ideological challenges loom over the Kingdom.

I recently returned from a three-week trip to Saudi Arabia, where I mixed work with a bit of sightseeing. Some of the country's attractions are truly grand, especially the Prophet's Mosque in Medina, which has recently opened to non-Muslims and the Nabatean facades of AlUla. While Saudi Arabia is modernizing and trying to attract tourists, I would recommend visiting in the next few years as the country prepares for an influx of tourists.

Saudi Arabia has embarked on a transformative journey to diversify its economy and attract foreign investment. The Kingdom has opened up to foreign ownership of businesses, introduced locally manufactured content requirements for government projects and has made significant strides in intellectual property protection. A notable shift in energy pricing, from a highly subsidized $0.01 per kWh to a slightly more market-reflective $0.05 per kWh, reflects a broader strategy to rationalize resource use and promote energy efficiency. Saudi Arabia's vision extends beyond its borders, aiming to establish itself as a hub for investment and a gateway for exporting to the broader region.

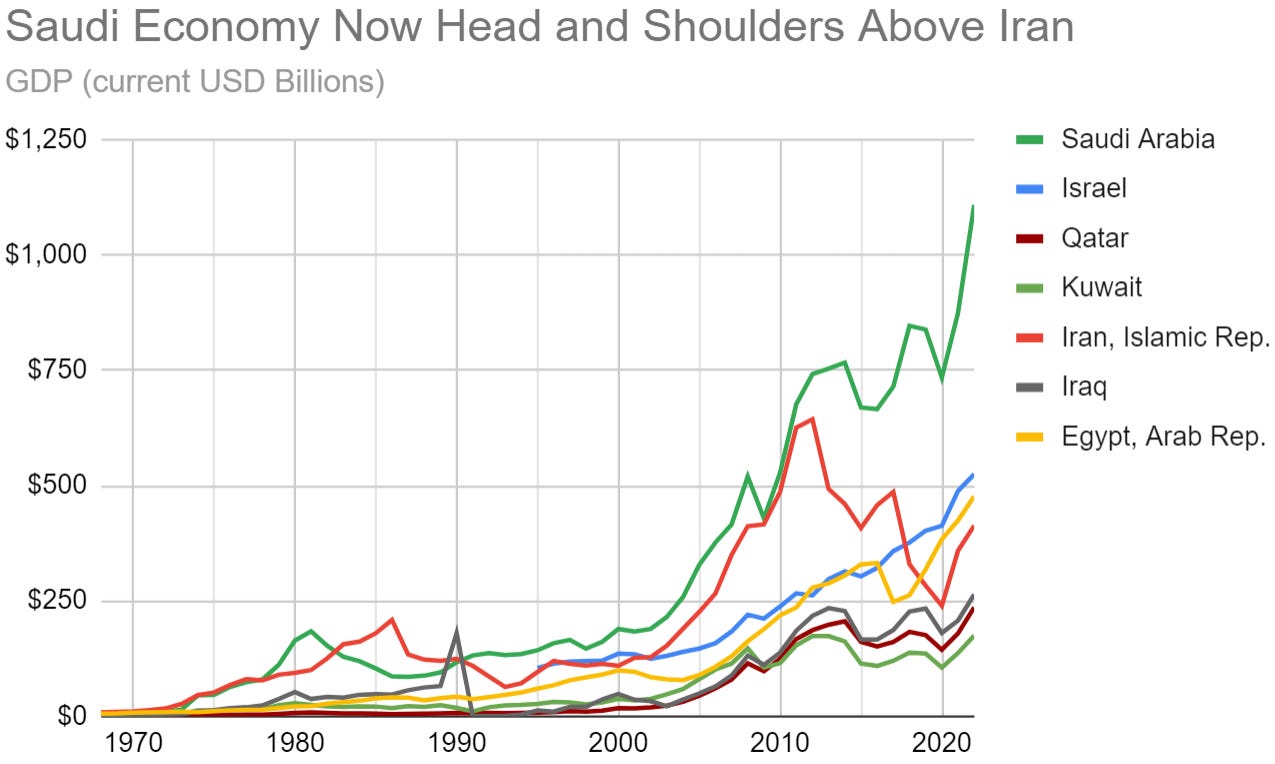

Saudi Arabia's economy, while substantial, is just over half of Australia's GDP but maintains its position as one of the top oil producers globally, second only to the United States. The nation is transitioning from its traditional role as a leading oil supplier, however, its capacity to quickly adjust oil production remains unmatched. Saudi Arabia aims to consolidate itself as a religious, military, and economic powerhouse, bridging the Arab world with the global community. The House of Saud has cultivated a reputation for stability and is forging a path toward economic innovation. However, the path of liberalization in the Muslim world has been marked by the downfall of kings, dictators, and oligarchs, where Saudi Arabia's administration will face the ultimate test.

Saudi Arabia's system of government, based on royalty and heritage, is complex and multifaceted, and combines traditional governance with modern structures in novel ways. The first order priority of the Kingdom has been to maintain independence and stability in a region where the concept of a nation-state is still relatively new. Arab thinkers have long grappled with the challenge of reconciling Islamic values and society with the rapid technological and civic progress in Europe. Saudi Arabia stands out in the region, having avoided colonization, Islamic revolution, unruly Mujahideen, and the Arab Spring. With the support of global powers, the Saudi monarchy has been instrumental in maintaining the country's stability and prosperity. The royal family has been able to navigate the complexities of modernization while still upholding the country's Islamic values and traditions. This has allowed Saudi Arabia to maintain its unique identity and culture while still embracing technological and economic progress.

Analyzing Saudi Arabia without bias is challenging due to its intricate ties with global powers, often at odds with its Arab neighbors' experiences with those same allies. Historically, Saudi's strict religious norms have limited personal freedoms and created a rift with Western perspectives. Yet, Saudi plays a crucial role in shaping moderate Islamic discourse. The Kingdom's complex relationship with the West combines conflicting cultural and religious values with mutual economic and security goals, and a shared interest in economic collaboration, making the dynamics between them complex. This overview aims to shed light on these nuanced relations.

While Saudi Arabia's future looks promising under Vision 2030, businesses and investors should study the of potential risks by understanding Saudi Arabia's complexities. Unraveling Saudi’s historical tapestry, from its origins to its evolution, is key to grasping the country's present identity and risks to its development trajectory.

The Saudi Origin Story

The first Saudi state was established in 1744 as an alliance between Islamic preacher Muhammad ibn Abd al-Wahhab and Saudi leader Muhammad ibn Saud, based on the principles of Wahhabism. The first Saudi state expanded through military conquest and became a major power, but was defeated by the Ottoman Empire in 1818. The second Saudi state was established in 1824 and led by Turki ibn Abdullah Al Saud, the founder of the modern Saudi royal family. The second state was able to re-establish Saudi control over much of the central Arabian Peninsula until 1891, when it was defeated by the rival Rashidi dynasty. The third Saudi state was established in 1932 by Abdulaziz ibn Saud, the founder of the modern Saudi state. Ibn Saud was able to unify the various tribes and factions of the Arabian Peninsula under his leadership and establish a centralized government and modern state institutions.

The British faced a difficult decision as they weighed whether to support Mecca, their Hashemite allies in the Arab revolt against the Ottomans, or Ibn Saud and the Saudi-Wahhabi movement. The Hashemites' broader ambitions for Arab unity and independence under Hashemite leadership were at odds with British (and French) imperial interests in the region, which aimed at maintaining control over territories and newly established mandates. The British decided to support Ibn Saud against the Hashemite Kingdom of Hijaz. The British support for Abdulaziz Ibn Saud during the formation of Saudi Arabia was a significant factor in his consolidation of power and the establishment of the modern Saudi state. This support was part of the broader British strategy in the Middle East, which aimed to secure British interests, particularly in relation to the route to India and access to oil reserves.

The defeat of the Sharif of Mecca's forces by Ibn Saud's forces in the early 1920s marked the end of the Sharif's dreams of ruling a unified Arab kingdom. After his defeat, the Sharif was exiled from Arabia and eventually settled in Transjordan, where he was made king by the British. From there, he and his descendants went on to rule Jordan, Syria, and Iraq, establishing the Hashemite dynasty that continues to this day.

Ibn Saud leveraged his understanding of tribal politics, his religious legitimacy, and strategic marriages to expand his control and consolidate the peninsula. The founding of the Kingdom of Saudi Arabia in 1932 marked the culmination of Ibn Saud's efforts to unify the tribes and regions under a single national identity. The leadership dynamics between the Hijaz and Najd were crucial in the formation of the modern Saudi state. The Hijaz brought religious prestige, while Najd contributed a robust ideological and military foundation through the Wahhabi movement. Abdulaziz's ability to balance and integrate these diverse elements was instrumental in the creation and stabilization of Saudi Arabia.

Arabian-American Cooperation, Aramco

After its establishment, Saudi Arabia, alongside Iran, stood out in the Middle East as one of the few states that never came under colonial administration. This unique status enabled the Kingdom to pursue independent development paths and form strategic alliances based on its national interests rather than colonial mandates. A pivotal moment in Saudi Arabia's history was the establishment of ties with the United States, which laid the groundwork for a partnership that would significantly impact the country's economic trajectory.

The foundation of the Arabian American Oil Company (Aramco) marked a departure from the British economic model prevalent in Egypt, Iraq, and other parts of the Arab world. Unlike the British approach, which often involved direct colonial control and economic exploitation, the American involvement in Saudi Arabia was characterized by sometimes tense, but overall collaborative effort to develop the Kingdom's oil resources culminating in 50-50 sharing of oil revenue after 1950 and full control by the Saudi government in 1970. This collaboration provided Saudi Arabia with the necessary technical know-how and capital investment to tap into its vast oil wealth, setting the stage for the country's future prosperity and strategic importance in global energy markets.

It is our wish and purpose that the processes of peace, when they are begun, shall be absolutely open and that they shall involve and permit henceforth no secret understandings of any kind (i.e. Sykes-Picot…). The day of conquest and aggrandizement is gone by; so is also the day of secret covenants entered into in the interest of particular governments and likely at some unlooked-for moment to upset the peace of the world. It is this happy fact, now clear to the view of every public man whose thoughts do not still linger in an age that is dead and gone, which makes it possible for every nation whose purposes are consistent with justice and the peace of the world to avow now or at any other time the objects it has in view. U.S. President Woodrow Wilsons, 14 points for peace after WWI.

Washingtons actions have been less than perfect in aligning with Wilsons ideals, but the emphasis on self-determination and transparent diplomacy set the foundation for the US-Saudi relationship. The relationship with the United States not only facilitated the extraction and export of Saudi oil but also represented a form of economic partnership that was markedly different from the colonial exploitation experienced by many of its neighbors. As a result, Saudi Arabia was able to leverage its oil wealth to pursue development and modernization on a negotiated version of its own terms, laying the foundation for its role as a key player in the global oil industry and international politics.

Distributive, Unproductive Economy

Saudi Arabia's economy has been heavily reliant on oil income and exports, a dependency that has shaped both its domestic and international economic strategies. The Kingdom is the world's largest oil exporter, with the oil sector accounting for about half GDP, 70% of export earnings, and more than 85% of budget revenues. This reliance on oil has allowed Saudi Arabia to amass considerable wealth, that was not driven by productivity. The state has used oil revenues to maintain social stability and loyalty through generous, non-performance-based government jobs. As of recent years, government spending has constituted a significant portion of GDP, with a substantial portion of the Saudi workforce employed in the public sector. This economic model has led to several challenges, including low productivity outside the oil sector and an extremely high energy consumption per unit of GDP.

New King, New Rules

In 2015 King Salman inherited a Saudi economic system grappling with budget deficits, prompting an ambitious path of economic reform. Despite the challenges, Saudi government finances remain healthy by global standards, thanks in part to the Kingdom's substantial foreign reserves and relatively low debt levels. However, recognizing the unsustainability of relying heavily on oil revenues amid fluctuating global oil prices, the leadership has embarked on Vision 2030, a comprehensive plan aimed at diversifying the economy, developing non-oil revenue sources, and implementing structural reforms. These reforms include the introduction of a value-added tax (VAT), privatization of state-owned enterprises, and efforts to attract foreign investment in various sectors beyond oil. The need for action was clear: to ensure the long-term financial health and stability of the Saudi economy, reduce its vulnerability to oil price shocks, and create a more dynamic and sustainable economic model for future generations. The stated goals of Vision 2030 are:

Increase the private sector contribution to GDP to 65%

Increase SME contribution to GDP to 35%

Increase FDI contribution to GDP to 5.8%

Increase the contribution of non-oil exports to non-oil GDP to 50%

Transforming Saudi Arabia's economy is a challenging task, mainly because the government's income is subject to global oil price fluctuations. This volatility affects the government's ability to sustain public sector wages, subsidies, and investments in new industries. Moreover, oil exports have been cyclical but stagnant since 2008, which further emphasizes the need for diversification. The oil price volatility has a direct impact on the country's current account surplus and investment in the growth in non-oil exports. Because of this dynamic, oil prices will remain the primary geo-economic indicator for Saudi Arabia, and maintaining them one of their primary geopolitical objectives.

To overcome these challenges, the government is making efforts to diversify income sources and increase non-oil revenue. However, these efforts face resistance due to their potential impact on the population's cost of living and the traditional social contract in Saudi Arabia.

Socio-Cultural Reforms

The initiation of social reforms in Saudi Arabia, marked by the historic decision to allow women to drive in June 2018, signifies a pivotal shift in the kingdom's approach to modernization and inclusivity. Spearheaded by MBS, these reforms are part of a broader strategy under Vision 2030. By dismantling some of the strict social codes that have long defined the kingdom, Saudi Arabia aims to improve its image on the global stage, attract foreign investment, and enhance the quality of life for its citizens. The reforms, including the opening of cinemas, the scaling back of the guardianship system, and the hosting of international sporting and entertainment events, are designed to make Saudi Arabia a more attractive place to live and work, not just for Saudis but for expatriates as well. This transition reflects an acknowledgment of the need for a more vibrant and open society to achieve the ambitious economic diversification goals set forth by the leadership.

Ideological Credibility And Stewardship

Saudi Arabia's leadership is often criticized for oppressing its citizens, but it's important to note that the country also has a large conservative population that resists social change. Additionally, Saudi Arabia plays a significant role as a source of moderate Islam, particularly as the steward of the two holy sites in Mecca and Medina. This role gives the country a unique responsibility to promote an interpretation of Islam which promotes stability in the region.

State Sanctioned Islam

Saudi Arabia's response to the challenge posed by Al-Qaeda and other extremist groups within its borders has been multifaceted, leveraging its unique position to assert religious credibility and authority. Recognizing the threat these groups posed not just to regional stability but to the very heart of Islamic faith and Saudi legitimacy, the kingdom initiated a comprehensive counterterrorism strategy. This approach included security measures, financial controls to stem the flow of funds to extremists, and an ideological counter-narrative to extremist interpretations of Islam. The kingdom supported religious scholars and institutions that espouse moderation and condemn violence. Through a combination of religious discourse, educational reforms, and rehabilitation programs for former extremists, Saudi Arabia has sought to reclaim the narrative of Islam from those who use it for radical ends.

Three centuries from the day we created glory with our own hands.

My fellow citizen... my resident brother... towards a society whose members participate in creating their security and aspirations. Field Operations Center 990, headed by State Security, receives your reports in full confidentiality about terrorism, misguided ideology, and everything that affects and threatens security, via the following communication channels.. Our awareness...is our safety.

This is the marketing SMS you receive in Saudi. SIM cards are also tied to fingerprints. This messaging could be described by conservatives as part of a campaign of religious oppression.

Remaking the Social Contract

The Saudi government's perspective on regional upheavals, from the Iranian Revolution to dictatorships in Iraq and the waves of the Arab Spring, has fundamentally shaped its approach to governance and reform. Witnessing the instability these events have brought to neighboring states, the House of Saud has historically emphasized strong leadership and control to safeguard its realm. Stability in its realm has always been priority number 1 for the Saud and it’s success is a strong point of difference from other Arab leaders. With Saudi established as the military and economic center of gravity in the region, the regional geopolitical landscape becomes relatively less threatening. Now the kingdom is embarking on ambitious economic projects and is navigating the delicate process of social reform. Historically, Saudi Arabia utilized the austere Wahhabi doctrine to foster societal unity, but it now faces the challenge of moderating this stance. Saudi leadership is tasked with integrating its conservative Islamic society with global norms, marking a significant pivot in its traditional governance model.

Weakening the Religious Apparatus

Saudi Arabia is taking steps to reduce the influence of religious police and establishments. The government has curtailed the powers of the religious police, formally known as the Committee for the Promotion of Virtue and the Prohibition of Vice, by restricting their ability to arrest and detain individuals. The religious police have historically been a powerful force in Saudi society, enforcing strict adherence to Islamic law and morality. However, in recent years, the government has sought to limit their authority and promote a more moderate form of Islam. The Saudi government has also taken steps to regulate and control the activities of religious establishments, such as mosques and Islamic centers, to limit their influence. Additionally, the government has launched initiatives aimed at promoting a more inclusive and tolerant form of Islam, such as the establishment of the King Abdullah International Centre for Interfaith and Intercultural Dialogue. These efforts are part of the Saudi government's broader strategy to modernize the country and reduce the strength of potential sources of opposition: religious traditionalism.

Reform is a Vulnerable Time for Islamic Leaders

The Shah of Iran, Mohammad Reza Pahlavi, faced opposition from conservative and religious segments of the Iranian population, partly because he was perceived as not being sufficiently religious and for his policies that aimed at secularization and westernization of the country. His rule, especially during the latter years, was characterized by rapid modernization efforts, social reforms, and efforts to reduce the influence of religious clerics in public life and politics. These efforts were encapsulated in the White Revolution, a series of reforms launched in 1963 that included land reform, the extension of voting rights to women, and the promotion of literacy and education.

These reforms, while intended to modernize Iran and improve social conditions, also alienated many in the conservative and religious communities, who saw them as a threat to traditional values and Islamic practices. The Shah's close ties with Western countries, particularly the United States, and his lifestyle, which was seen as extravagant and out of touch with the everyday struggles of many Iranians, further fueled discontent. This opposition eventually contributed to the support for the Islamic Revolution in 1979, led by Ayatollah Ruhollah Khomeini, which resulted in the Shah's overthrow and the establishment of the Islamic Republic of Iran. The revolution was supported not only by religious conservatives but also by various segments of society who were dissatisfied with the Shah's authoritarian rule.

The rapid liberalization of Iran under the Shah's rule serves as a cautionary tale for leaders of Islamic countries who seek to modernize their countries, as it can create vulnerabilities that empower conservative elements of society against ruling families. Tehran will be closely watching these dynamics as Saudi Arabia liberalizes, looking for opportunities to undermine al-Saud through conservative elements of society.

Challenge to the Saudi-Iran Detente

Saudi Arabia needs a calm and stable situation to make Bin Salman's "Saudi Vision 2030" operational, so it welcomed Iran's interaction with other Persian Gulf countries in economic, security and political fields, he added." IRNA, Iranian State Media

As part of the Saudi-Iranian detente, Saudi Arabia allegedly agreed to limit its support for media networks that have been critical of the Iranian regime, while Iran supposedly committed to reducing arms shipments to Houthi rebels in Yemen. However, these promises have appeared to lose credibility in the wake of increased Houthi activity and the spread of anti-Iranian narratives in Saudi media. While the Houthis have been aiming south and not north since Oct 7th, the fragility of the detente is evident. Allowing the young MBS to continue full speed down the path of reform may provide Iran with an ideological opening to undermine al-Saud. While the detente has kept a lid on violence, the competition and conflict is far from over.

The litmus test for the deal’s success [Saudi-Iran detente] will be whether the sides keep interfering in the domestic politics of countries across the region. Riyadh has long complained about Iranian support for militant groups across the region and alleged Iranian attempts to stir up rebellion among Saudi Arabia’s minority Shiite population. Likewise, Iran has accused the Gulf Arab states of facilitating the presence of the U.S. and Israel on its doorstep. There are two obvious first steps Iran and Saudi Arabia can undertake to demonstrate their commitment to non-interference, both of which the two countries reportedly agreed to as part of the deal itself. Saudi Arabia reportedly said it would curb its support for media networks that have agitated against the Iranian regime, while Iran reportedly said it would curtail arms shipments to Huthi rebels in Yemen. [both of these promises appear to have lost credibility with amplified Houthi activity, and counter Iranian narrative being spread in Saudi media] The Impact of the Saudi-Iranian Rapprochement on Middle East Conflicts, Crisis Group, April 2023

Modernization Over Secularization

Mustafa Kemal Atatürk, the founder of the Republic of Turkey, implemented radical reforms in the early 20th century to secularize and Westernize Turkey, transitioning it from the remnants of the Ottoman Empire into a modern, secular nation-state. Atatürk's reforms included the abolition of the Caliphate, introduction of the Latin alphabet, Western legal codes, and the promotion of secular education. Unlike MBS, Atatürk explicitly reduced the role of Islam in public life and governance, aiming to separate religion from the state entirely.

Turkey's lira dropped further on Monday before recovering slightly following a speech by Turkish President Recep Tayyip Erdogan on state television that cited Islam as a reason for not raising interest rates despite a rapidly depreciating currency and rampant inflation… Erdogan insisted it was Islam that guided his decision in demanding the central bank keep interest rates low... "As a Muslim, I will continue doing what our religion tells us. This is the command," Turkey: Lira falls as Erdogan cites Islam on monetary policy

Erdoğan's reversion towards a more overtly Islamic governance model in Turkey demonstrates the potential for religious identity to regain prominence in public policy, even after periods of secularization. This highlights the importance of caution in assessing the trajectory of Saudi Arabia's reforms under MBS. As such, the balance between modernization, economic reform, and the maintenance of Islamic identity presents a complex challenge for MBS and the Saudi leadership.

The comparison of MBS to Atatürk and the observation of Erdoğan's leadership offer valuable insights into the challenges of reform in predominantly Muslim countries with strong religious identities. MBS's reforms, while aimed at modernization and economic diversification, do not entail a wholesale secularization of Saudi society. Instead, they represent an attempt to balance modernity with Islam's role in public and private life.

Economic Reforms

Upskilling Saudi Industry

As part of vision 2030, the government has invested heavily in education and training programs, including technical education. This has led to a significant increase in the number of Saudi nationals pursuing technical degrees in engineering. Saudi Arabia has one of the highest percentages of adults entering tertiary education for the first time, at 73%, above the OECD average of 66%, with the highest new entry rate at bachelor's or equivalent level, at 59% (OECD average, 57%). 98% of Saudis at age 18 are in secondary, post-secondary non-tertiary or tertiary programs, the highest rate of all countries (OECD average, 76%).

Reforming Energy Markets

Saudi Arabia's energy consumption per GDP is among the highest in the world. According to the World Bank, in 2020, Saudi Arabia's energy consumption per GDP was 0.37 kWh per dollar of GDP, which is significantly higher than the global average of 0.07 kWh per dollar of GDP. Saudi Arabia's economy is highly energy-intensive, primarily due to the country's heavy reliance on energy-intensive industries such as oil refining, petrochemicals, and desalination. Globally, Saudi Arabia ranks among the top ten countries in terms of energy consumption per GDP. This is a concern for the country's economic sustainability, as the government subsidizes energy and water which burdens the states financial resources while consuming oil which could otherwise be used for the export market.

Increasing Electricity Prices

One of the key reforms has been the increase in energy prices, which have been raised from SAR0.05/kWh (1.3 cents) to SAR0.18/kWh (4.8 cents). This hike in energy prices is still ridiculously cheap but is part of the country's efforts to reduce its dependence on oil exports and promote renewable energy sources. Electricity rate increases have to be done in proportion to capex replacement cycles. There is a glut of inefficient machinery and infrastructure in Saudi that would be completely uneconomic at market driven energy costs. If prices were raised overnight all of that equipment would be impossibly expensive to operate. Saudi Arabia has set ambitious targets to increase its renewable energy capacity, with plans to generate 50% of its electricity from renewable sources by 2030 which is unfeasible at the current low prices, so businesses can expect more price raises. This will dramatically raise demand in Saudi for efficient machinery and infrastructure.

Forcing Product Localization

In a move to boost local employment opportunities and promote local manufacturing, the Saudi Council of Ministers issued a decision in 2021 (Cabinet Resolution 658) extending local content regulations to companies majority-owned by the state. This decision is an extension of the Local Content and Government Procurement Authority's (LCGPA) original laws covering government procurement. The key aspects of the new regulations include:

Mandatory list of national products: Companies must comply with a list of national products. Any national products on this list must be purchased locally.

Mandatory reporting: Companies must report annually their local content score.

Price preference for SMEs: All contracts with an estimated cost of less than SAR 50 million ($13.3 million) can buy local products at a 10% premium.

Price preference for local content: National products may be given a price preference.

Weighting of local content score: As part of a financial bid, the weighting of a vendor’s local content score can’t be less than 30%.

The new regulations will have significant implications for companies doing business in the Kingdom, especially those that do business with SOEs on megaprojects. Foreign companies will have to establish local production or build relationships with local producers in their industries. These partnerships are key to competitive pricing and efficient procurement agreements.

Establish Saudi as a Manufacturing Hub in The Region

While the UAE and other GCC countries continue to rely heavily on imports, Saudi Arabia is taking a different approach. By enforcing local content regulations, Saudi Arabia aims to create new opportunities for local businesses but also reduce its reliance on imports.

The localization laws came into effect in 2022, so their effects are yet to be measured in the economy, however non-oil exports in Saudi have increased 12% YoY for the past two decades. Extrapolating this trend out would increase the contribution of non-oil sector to 40% to 50% of GDP by 2030. Every single manufacturer in the Middle East I spoke to (at least 10) who provide inputs to the construction industry were in the process of establishing manufacturing operations in Saudi. Smaller companies were doing JV’s and larger companies invested the requisite capital to run manufacturing operations themselves.

Localizeflation

The Saudi government is a significant contributor to construction projects, with more work available than local players can handle. This presents a significant opportunity for driving growth of locally manufactured goods; however, there are some challenges for Saudi manufacturing.

Saudi manufacturing wages are much higher ($10-15/hr) than those in South Asia and Egypt ($4/hr), making locally manufactured goods more expensive which will ripple through construction costs. However, for higher-value products, Saudi manufacturing may still be globally competitive. The localization requirement for government projects will increase construction costs which adds to inflationary pressure, forcing local manufacture for all products will increase costs for low value add/commodity products.

For regional economies in Iraq, Syria, and Lebanon, lower-cost goods may be sourced from Egypt, India, or South Asia. As an example, Egypt exports more wire cable than Saudi, while Saudi exports more mobile phones and electronics. Saudi Arabia will be a source of mid/high-value products, while lower-cost goods will likely be imported from other regions.

Reduce Government Employment

For several years, Saudi government jobs have offered Saudis an easy way to profit from their country's oil riches. With the Saud family princes enjoying lavish lifestyles and substantial annual stipends, the only opportunity for everyday Saudis to capitalize on their oil heritage was through obtaining a government position.

In the early 2000s, Saudi government employment made up close to 50% of the total workforce, significantly higher than international standards. In contrast, countries such as the USA and Australia maintain public sector employment rates of around 15-18%, while Japan's rate is below 10%. Nordic countries, with their extensive welfare states, have government employment rates of approximately 30%.

The high percentage of government employment in Saudi Arabia can be attributed to several factors, including the expansion of the public sector during the oil/China boom era and the government's efforts to provide employment opportunities for the growing Saudi population. These jobs have often not been performance based, productive roles. The Saudi government has been taking steps to reduce its share of employment and promote private sector growth. Consequently, government employment as a percentage of the total workforce has been gradually decreasing, following a downward trend since its peak in the early 2000s.

Achieving Nordic levels of government employment, around 30%, is a realistic and desirable goal for Saudi Arabia. On its current trajectory, the country would reach a government employment rate of approximately 30-32% by 2030. This would leave 65-70% employment in the private sector, roughly in line with the Vision 2030 goal of private sector contribution to GDP to 65%.

Saudi IP Law is in a Different League to China

Saudi Arabia has made significant strides in intellectual property (IP) protection and enforcement, leading to its removal from the Priority Watch List of the United States Trade Representative (USTR) in 2022. The Saudi Authority for Intellectual Property (SAIP) has taken various measures to strengthen IP protection, including publishing its IP enforcement procedures, increasing enforcement against counterfeit and pirated goods and online pirated content, and creating specialized IP enforcement courts with trained judges and expedited timelines. The removal of Saudi Arabia from the USTR Priority Watch List in 2022 is a significant achievement, given that Saudi Arabia was previously listed alongside countries like China, with next to zero IP protection.

Foreign Business Ownership Reform

Saudi Arabia, the largest economy in the Middle East, has long been known for its conservative business environment, particularly when it comes to foreign ownership. Historically, foreign investors were only allowed to own up to 49% of a business in Saudi Arabia, with the remaining 51% being owned by a local partner. However, in recent years, the Saudi government has made significant strides in reforming its business ownership laws.

In order to support the increase FDI contribution to GDP to 5.8% the Kingdom introduced the "Foreign Investment License" in 2019. This license allows foreign investors to establish a business in Saudi Arabia with 100% foreign ownership provided they invest a minimum of 30 million Saudi Riyals (approximately USD 8 million) in the business. The structure of the Foreign Investment License favor large multinationals, while protecting the SME, and tech startup space for Saudi’s.