Chip Shortage Update, Fab Wars and Chip Industry Consolidation

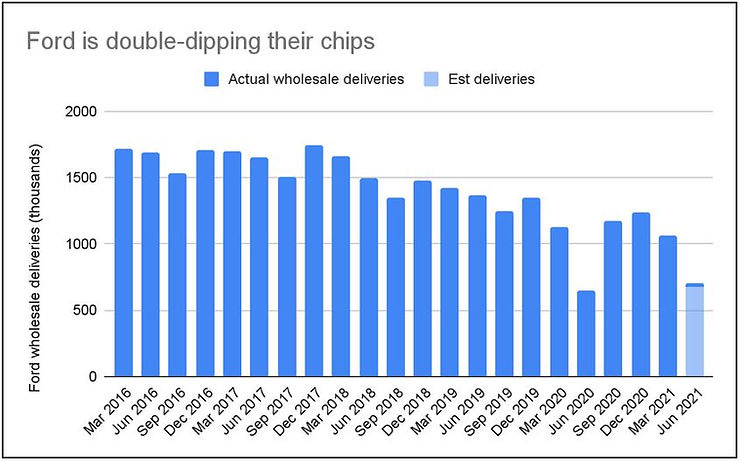

The semiconductor industry is adapting to the chip shortage and, business is booming but, there are victims of the supply crunch. The automotive and consumer electronics sectors are having to cut back production at huge costs for some manufacturers.

Amidst the shortage and increased awareness of the importance of semiconductors, chip companies are jostling for market share, niches and government benefits. TSMC and Intel are competing for technology leadership and preferential construction deals, while SMIC is trying to absorb as much capacity as possible by serving the supply-constrained automotive and consumer electronics sector. SMIC is increasing production at advanced nodes like 14nm but is having difficulty achieving scalable unit economics.

Once the new government-funded capacity comes online and, chip stockpiling from consumers subsides, it is an open question what will happen to the semiconductor manufacturers. In the current chip shortage, manufacturers are making hay while the sun is shining.

In the next year or two, smartphone and PC sales will likely return to relying on the replacement cycle for ongoing revenue. The chip industry may depend on data centre spending and IoT markets for continued growth. If demand fails to meet expectations, there could be broad overcapacity in the chip supply chain.

There was already a lot of consolidation in the chip industry, with 2020 setting record numbers for M&A. An oversupplied environment could create opportunities for even more consolidation as pricing and competitive pressures mount. Manufacturers who build cash during the pandemic boom will buy out those who struggle with reduced demand and falling prices.