Chip Shortage, Taiwan Conflict and Semiconductor Independence

The semiconductor shortage is spreading and will materially impact industrial production for 2021. Autos are the most obviously impacted, and other sectors will need to be analysed on an individual basis. Companies and governments are making unprecedented investments into chip manufacturing capacity. However, key end-use markets are reaching saturation. This risks leading to over-capacity causing a semiconductor bubble to form and then pop on the back of less geopolitical stockpiling and collapsing demand, this is one to watch out for.

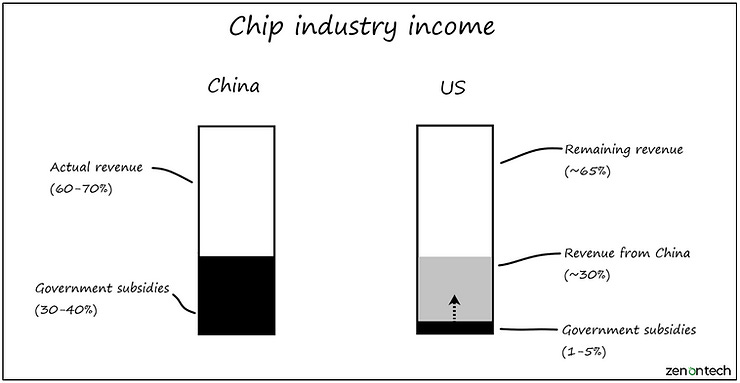

China will struggle to meet its goals of technological self-reliance over the next decade. China's foundries will likely lag behind the leading edge technology due to lack of advanced manufacturing equipment and design tools. However, the Chinese chip industry has the capability to supply the domestic market to build infrastructure for 5G and other key technologies. China’s economic upgrading goals may be achievable, depending on the severity of US sanctions.

Huawei has taught the US over the past two decades that Chinese companies can be world-leading if they are allowed to grow by any means possible. The US sanctions have killed Huawei’s mobile business but if the strangulation strategy is repeatedly used, then the risk of conflict over Taiwan increases. The US can use a targeted tech trade policy to slow down Chinese chip manufacturing and military technology while not denying the modernisation of the Chinese economy.

The US has the firepower to establish sufficient production capacity at leading nodes on its territory over the next decade. As such, the US could slowly become less technologically dependent on Taiwan while China remains two generations behind. A chip bubble pop would suddenly weaken Taiwan's position in the great power conflict as chips make up 35% of Taiwanese exports. Lower chip prices, over capacity, profitability challenges and a weaker economy would give Taiwan less ability to defend themselves against economic coercion and military force.

The US wars in the Middle-east ended after achieving energy independence. However, the US retains a large presence in the Middle-east as China becomes increasingly dependent on the region for energy. The US could pivot its attention away from Taiwan after achieving semiconductor independence, but it may have other reasons to stay engaged, if only to deny the Chinese chip industry access to Taiwanese foundries.