China's Options for Semiconductor Security

China is responding to US sanctions by expanding production of legacy chips and expediting the development of chip making equipment. Expect more US sanctions.

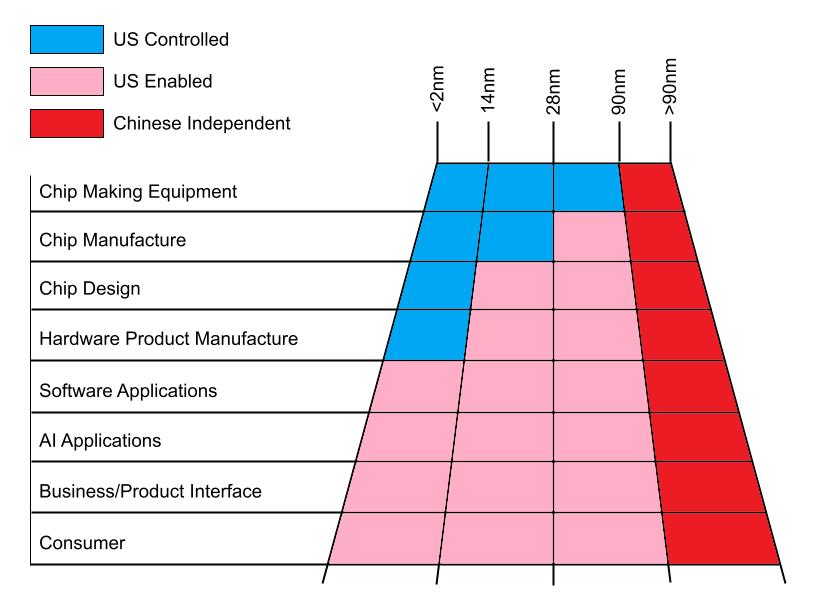

Status of the Chip Choke. In October 2022, the U.S. ramped up sanctions on China's semiconductor industry, targeting advanced chips essential to AI development and pushing back China's technological aspirations. SMIC, China's primary chip manufacturer, can produce moderately advanced chips, but it risks regressing to 2003-level technology if completely cut off from U.S. advancements. While China is preparing their economy for potential US sanctions, we see clear evidence they are also preparing their industrial base for conflict.

China Expanding Production of Older Tech. In retaliation to the U.S. sanctions, China has fortified its older technology chip production. Beijing's $140 billion investment and SMIC's strategic refocus are evidence of this. While their main revenue streams come from older technology chips, SMIC has witnessed significant growth, with its revenue soaring past $7 billion in 2022. SMIC's revenue is a mere tenth of TSMC's, while the difference in wafer shipments is only half: 7.1M wafers for SMIC compared to 15.2M for TSMC. This indicates a lower average selling price for SMIC and a predominance of older chip technology sales. While the global chip industry (except for AI) is experiencing a cyclical downturn in sales Chinese fabs are buying Western chip making equipment like there’s no tomorrow.

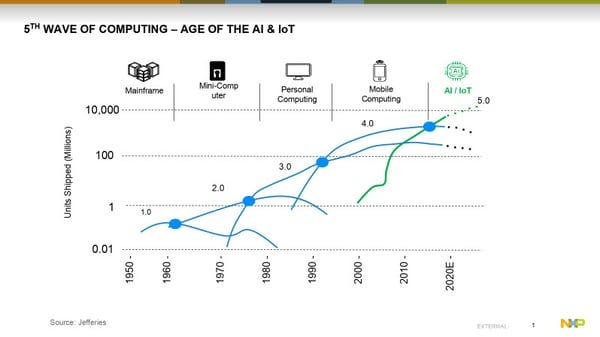

Expect US Response with Trade Duties. American thinkers are anticipating China's potential flooding of the market with legacy chips, a move that could shift the dynamics of the semiconductor industry. To counter this, the U.S. might employ proactive measures like antidumping/countervailing duties. However, considering that 70% of SMIC's revenue comes from China, we argue that any punitive duties would need to target final products using these chips to deter manufacturers from sourcing subsidized Chinese chips. This is a relevant issue since we are entering the IoT era of ubiquitous, commoditized compute.

US Equipment Leaves China Vulnerable to Cyber Attacks. China's reliance on Western machinery interlaced with foreign control systems opens doors to potential cyber threats. Drawing parallels from events like the Stuxnet attack on Iran, China's infrastructure remains at risk. To curtail this vulnerability, China must innovate its industrial machinery, reducing its dependence on foreign systems.

China Expediting the US Free Chip Supply Chain. In the realm of semiconductor equipment manufacturing, Chinese companies face tremendous challenges in catching up. SMIC, while having a robust revenue stream and foundational machinery, is in a better position than its Chinese equipment maker counterpart, SMEE. As China treads the path towards 2030, the stakes are high: domestic manufacturing prowess is paramount to stave off potential production declines at the leading edge due to machinery degradation.

I don’t currently think we can rule out SMEE launching a 14nm lithography machine by 2027. One pivotal marker to watch will be the slated release of their 28nm machine by the end of this year, which holds immense weight in mapping out China's semiconductor roadmap. Connecting these dots, we're reminded that the heart of this saga is intricately linked to China's desire for economic resilience amidst potential sanctions and Xi’s strategic calculus in preparing for a Taiwan invasion by 2027. As the world closely watches the dance between technology and geopolitics, China's path in the semiconductor domain holds broader implications beyond just industry dynamics. The ebb and flow of their progress serve as a barometer for the nation's overarching objectives.

Download the full analysis below.