Back in 'Nam; The Zero Sum Game

Vietnam's gain is China's loss, all while creating long term value for the US. But with a historical North/South divide, Vietnamese leadership will need to be careful.

Following Biden's recent Vietnam visit and evolving trade patterns, Vietnam's role in international trade and geopolitics has garnered increased attention. This article delves into Vietnam’s relationships with both China and the U.S., highlighting its economic and technological interplays. Readers will gain insights into the changing dynamics surrounding Vietnam, identifying potential opportunities and risks.

Vietnam's strategic position is complex. Its proximity to China and historical ties, make them weary acquaintances. And now the gravitational pull of the U.S. economy - compounded by China’s assertive expansionism - pull Vietnam towards a closer alliance with the U.S.

The Vietnam war ended in 1975 victory for the communists. Vietnam ended the war as a formidable fighting force capable of threatening the Peoples Republic of China. Since the war's end, Vietnam and China have had recurring conflicts over borders, fishing rights, and regional influence, initially involving military confrontations which have gradually subsided over time.

Vietnam is aiming to strike a balance by aligning with both China and the U.S., however the competing interests of Vietnam and China are evident. Vietnam's burgeoning electronics industry, its abundant rare earth mineral resources, and its pivotal position in Asia's trading channels make it a prime candidate for foreign investments seeking alternatives to China. Additionally, China's actions in the South China Sea not only challenge Vietnam's territorial rights but also negatively affect the Vietnamese public’s perception of China. This aggression drives Vietnam to seek support from the U.S., to strengthen its negotiation power with China. Winning Vietnam's alliance will come at an economic and strategic cost for China via reduced control over global manufacturing, rare earths and the South China Sea.

However, this tightrope needs to be viewed with caution by the Vietnamese leadership. The north of Vietnam witnesses preferential investments from Chinese firms, while American companies are inclined towards the south, driven by geographical and strategic motivations. Notably, the south has been the epicenter of anti-Chinese sentiments. To maintain harmony, the Vietnamese authorities will need to invest significant effort in fostering national cohesion and control.

What Singaporeans need to understand better is that, under present circumstances, there may be no sweet spot we can occupy that will keep both the Chinese and the Americans simultaneously happy. There is no silver bullet, and it is a fool's errand to look for one.

Neither can we just lie low and hope for the best. You may not look for trouble but trouble may come looking for you. And trouble is all the more likely to seek you out if either side thinks you are, or can be, intimidated.

We must have the courage to pursue our own national interests. Sometimes our national interests may lead us to tilt one way, sometimes the other. But it must always be our national interest that guides us and nothing else.

Both the Chinese and Americans may not be too happy with us for pursuing our own interests. But Singapore does not exist to give joy to American or Chinese hearts. So long as neither side is so unhappy that it dismisses us as unredeemable, we can live with their unhappiness and manage it. Straights Times

China’s Expansionist Behavior Invites Opposition, Seeds of a Westphalian System

While Beijing is nestled in the Bohai Sea, China has no buffer zone between its most economically successful coastal provinces that house Shenzhen and Shanghai and the vast ocean. This geographic vulnerability is a driving factor behind China's maritime behavior. While China’s 9 dash lines and expansionist behavior seems like the perfect way to ‘lose friends and alienate people’, Beijing views it as vital for ensuring operational space, establishing early warning systems, and executing anti-access/area-denial and deterrence tactics. This reasoning parallels the current reasoning of Moscow in maintaining a buffer zone on it’s Western border. And as events in the Western Pacific unfold I encourage readers to ponder that reality.

The South China Sea is a buffer-zone for the southern Chinese mainland. China’s control of the region will allow it to create a military barrier from which it can challenge any future military threat. For example, any trade blockade, by any state or a coalition of states, against China could only be achieved through dominance of the South China Sea. A strategic analysis of the South China Sea territorial issues, Japanese Naval College

Vietnam is not alone in these challenges, just about all ASEAN nations have had run-ins with China on this issue. Chinese ships have very recently been obstructing Philippine vessels trying to resupply their BRP Sierra Madre military base. China defended its actions by stating the vessels had trespassed without permission.

I was at the recent Australian Strategic Policy Institute (ASPI) conference in Canberra featured Ignacio Madriaga, Undersecretary for Strategic Assessment and Planning, Philippines Department of National Defense. Madriaga emphasized that from the Philippine perspective, deterrence is already missing the mark with China's deviation from established UNCLOS norms. He adeptly highlighted China's use of four "AIs" in its strategy

AI-1: Artificial Islands: Constructing man-made islands to gain control over crucial maritime pathways. These islands not only serve as strategic footholds but are also equipped with military installations, extending China's capabilities to project power and influence in the region.

AI-2: Alternative Interpretation of international norms: Manipulating international norms to their advantage, exemplified by the contentious 9-dash line. This line is a delineation that China uses to claim vast swathes of the South China Sea, well beyond what is internationally recognized in the UNCLOS framework.

AI-3: Aggressive Interaction: Engaging in confrontational behaviors, such as shadowing and obstructing Philippine ships. Beyond mere intimidation, these actions underscore China's aim to exercise de facto control over contested waters..

AI-4: Artificial Intelligence: Deploying cyber warfare techniques, including espionage operations targeting regional adversaries, cyberattacks against critical infrastructure, and disseminating disinformation to shape the narrative in China's favor.

Madriaga concluded that China has been attempting to slowly change the status quo, and that the response needs to be another AI, All Inclusive. This shift in narrative brings rise to a Westphalian maintenance of the balance of power between states. The Philippines doesn’t care about anyone’s strategy to contain China, all they care about is thwarting China’s hegemonic ambition in the region.

In what this paper argues is a provisional solution, the US has acted as guarantor to regional stability providing a military umbrella which does not offer an enduring resolution to the problem, and indeed risks rapid escalation particularly in the wake of any military miscalculation.

Recognising that the current strategy lacks coherency and unity of effort, the paper then sets out an alternative, collegiate and blended approach. The core of this strategy is based on the need to compel China to accept the rules based international system. The strategy seeks to avoid threatening Chinese sovereignty but re-emphasises the validity of International Law and the application of rules based convention. A strategic analysis of the South China Sea territorial issues

Vietnamese are More Hawkish Than Japan and S. Korea

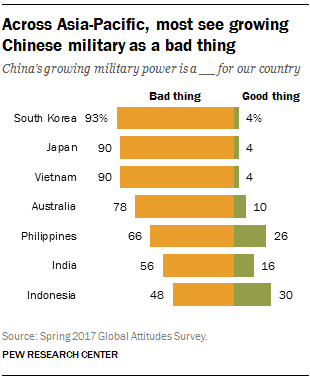

The Asia-Pacific region presents a kaleidoscope of views towards China's rising economic clout. Australia, for instance, largely sees China's economic growth as a boon. In contrast, India and Vietnam’s sentiments are largely skeptical, with only a small fraction deeming China's ascent as advantageous for their nation.

Vietnam shares a unique relationship with China, characterized by both cooperation and competition. As China's economy has surged, Vietnam has increasingly viewed this ascent as a double-edged sword. On one hand, China's economic activities bring opportunities for trade and investment. On the other hand, there's a prevailing sentiment in Vietnam that the countries are in a zero-sum competition, especially in sectors like manufacturing and exports. With both nations vying for a slice of the global market, Vietnam often finds itself in direct competition with its massive northern neighbor.

The predominant concern in the Asia-Pacific region, including Vietnam, revolves around China's expanding military strength. Vietnam, alongside South Korea and Japan, is wary. All three countries have had military confrontations with China in the last century and ongoing territorial disputes in the East and South China seas. In Vietnam's case, nearly all surveyed citizens believe China's escalating military prowess could pose a threat to their nation.

China Tech? Not in ‘Nam

Vietnamese sources state the belief that Huawei products are being exported at below market prices to “supervise the world”. Vietnam shunned Huawei from their telecommunications networks while bringing in Ericsson and developing their own domestic competitor to Huawei. The Vietnamese are deeply suspicious of Chinese technology and will put domestic sovereignty ahead of cost.

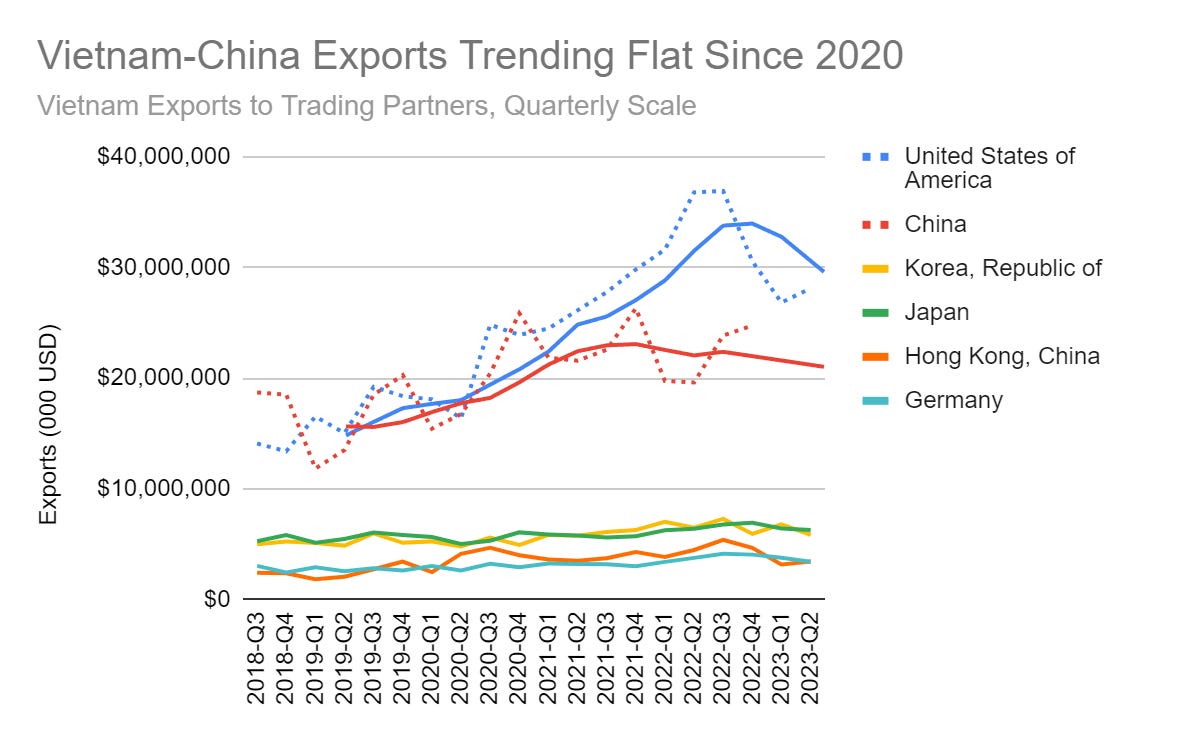

While China's economic trajectory has been wavering, Vietnamese exports to China have been stagnating since 2020.

US-Vietnam Relations Erodes China’s Position

During Bidens recent trip to Hanoi, the U.S. was elevated to the highest diplomatic rank, Comprehensive Strategic Partnership. This elevation came after Vietnam's diplomatic interaction with Australian Prime Minister Anthony Albanese, resulting in various agreements and the release of Australian citizen Chau Van Kham. Vietnamese news sources state that Australia is set to follow in becoming a Comprehensive Strategic Partner of Vietnam.

Put it in perspective, this propels the US into the rarefied pantheon of Việt Nam's close partners - China (which Việt Nam set up Comprehensive Strategic Partnership in 2008), Russia (2012) , Japan (2014), India (2016), Republic of Korea (2022), and Singapore. Indonesia, Australia set to follow - other than Việt Nam's special friendship with its two Indochina neighbours Laos and Cambodia along with the Latin American fraternal partner Cuba. vietnamnews.vn/

Several collaborations were announced with companies such as Boeing, Microsoft, and Nvidia. Emphasis was placed on sectors like cloud computing, semiconductors, and artificial intelligence. Key stakeholders from industries, including Google and Intel, also participated in discussions. Among the agreements, notable mentions include a $7.8 billion agreement with Boeing, the establishment of semiconductor hubs in Ho Chi Minh City, and AI projects with Nvidia and Microsoft. The semiconductor hub is set to be in South Vietnam - in the event of conflict, operations in Hanoi and the shipping lanes in the Gulf of Tonkin could be strongly influenced by China.

"The semiconductor partnership in particular has the potential to help Việt Nam's export-oriented economy rise further up the value chain. Higher-value industrial activity will improve Việt Nam's productivity, which is key to the next stage of its extraordinary growth story.” Nick Ferres, Chief Investment Officer at the Singapore-based Vantage Point Asset Management. vietnamnews.vn

Any benefits to U.S. owned companies will be small, they will take time to ramp up and will only mitigate a portion of the downside geopolitical risk from worsening relations with China. However it is important to note is that Vietnam is adopting U.S. technology rather than Chinese.

Export Growth Driven by Phones, Chips to Come

In looking at the type of products being exported by Vietnam, it becomes very clear that Vietnam’s export boom has been driven by phone manufacturing and assembly. Vietnamese phone exports to the U.S. have been accelerating since 2012, exports to China followed a few years later. Other exports from Vietnam such as semiconductor devices are slowly picking up speed and we expect the growth in Vietnamese exports to broaden to other products.

Phone manufacture in Vietnam is predominantly done by Samsung with over 80% share, followed by Apples contract manufacturer Foxconn. Notably Huawei doesn’t have a manufacturing footprint in Vietnam. Xiaomi only starting shipping made in Vietnam phones in 2022, out of North Vietnam. Vietnams phone export boom has come at the expense of Chinese factories. Vietnam's economic advancements, such as VinFast's listing on Nasdaq, highlight the growing relevance of Vietnams tech sector and their direct competition with Chinese companies in the global markets.

China and Vietnam Have Conflicting Economic Interests

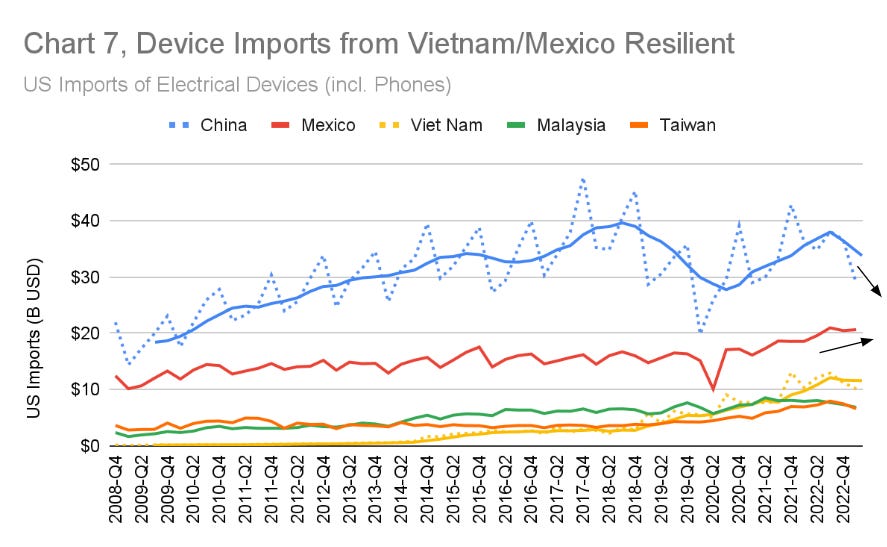

1: Vietnam and China Occupy the Same Position in the US Supply Chain

While China's economic trajectory has been wavering, with growth rates dwindling to just above 3% and challenges like plummeting real estate values and rising youth unemployment, it presents a unique opportunity for countries like Vietnam. As US imports from China have decreased, reaching $771B in Q2 2023 from a peak of $879B in Q2 2022, nations like Vietnam, are stepping up to fill the gap. Notably, US imports from Canada and Mexico have surpassed those from China, reflecting a significant change in trading dynamics.

We interpret these trade shifts as a transition in consumer spending from goods to services, dovetailing with a cyclical downturn in the devices sector and a strategic move towards onshoring or friend-shoring. China, with its export economy focused on electrical devices and in geopolitical competition with the US, stands vulnerable to these potential slowdowns. Even though a potential rebound in the electronics market might temporarily elevate US imports from China, the momentum towards diversifying supply chains to regions like ASEAN, including Vietnam, is set to continue.

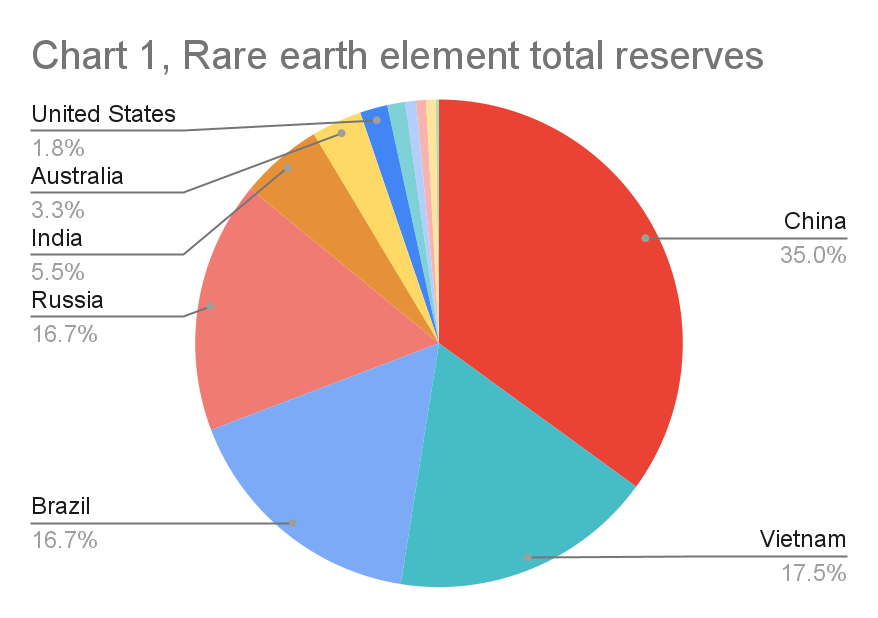

2: Vietnam’s Rare Earth Opportunity = China’s Loss of Leverage

The Biden administration made REE’s a key focus of the Vietnam trip per the following White House briefing:

Diverse and Securing Critical Mineral Supply Chains: A bilateral Memorandum of Understanding strengthens technical cooperation to support Vietnam’s efforts to quantify its Rare Earth Elements (REE) resources and economic potential, attract quality investment for integrated REE sector development, and meet high environmental, social, and governance standards. White House briefing

China's decision to control exports of certain rare earths, citing national security, has triggered a global reaction. Although China has a dominant position in rare earth production, its previous attempt to leverage this against Japan backfired, reducing its global market share from 97% to 60% within a decade (Zen on Tech V15). The US is also actively encouraging nations like Australia and Canada to increase their production of rare metals. As the US fosters stronger ties with emerging markets in the Indo-Pacific, it aims to harness their untapped mineral resources.

Extracting mineral resources from their vast reserves is perhaps one of the most feasible ways for Vietnam to generate tax revenue. It will be hard for China to stand in the way of Vietnam making the most of their resources.

3: Vietnam Wants Freedom to Operate Within it’s EEZ

China has sought to tap into marine resources in the South China Sea, which the Vietnamese people deemed egregious economic theft. Yet, in the current balance of power Vietnam has limited capability to defend its regional interests without collaboration with other nations and the backing of the US.

In 2014, riots broke out at industrial parks near Ho Chi Minh City, with protesters looting and damaging Chinese factories. The Associated Press reported that around 20,000 people had participated in initial peaceful protests in Binh Duong province. The unrest began after Beijing placed an oil rig, Haiyang Shiyou 981, in water 70 miles within Vietnam's exclusive economic zone (EEZ).

Is Vietnam a Reliable Partner for the US?

Just a week ahead of Biden's visit to Vietnam, a Chinese delegation visited Vietnam:

"Highlighting the tradition of friendship and mutual assistance between the two Parties, the two countries and the two peoples, Trong expressed appreciation for the Chinese people's help to Vietnam's revolutionary cause and socialist construction and national development over the period, as well as the contributions of Chinese senior leaders, particularly Party General Secretary and President Xi Jinping, to the development of Vietnam-China relations in recent years." e.vnexpress.net/news

Vietnams government is ideologically similar to the CCP and they score very low on personal freedom indices that we value in democracies. However they are deeply suspicious of China because of their long history of Chinese rule and recent history of territorial disputes. Vietnam is primarily concerned with sovereignty, territorial integrity and economic prosperity. We argue that Vietnam will aim to extract territorial concessions out of China vis a vis international norms by partnering with regional allies and the U.S. Vietnam will step in to economically engage with the West as the U.S. ‘de-risks’ from China. Unless China can craft a strategy of engaging with Vietnam we see this as negative for Chinese manufacturing.

If conflict were to break out in the region over Taiwan, Vietnam would likely try to avoid getting involved. Their focus would be on securing maritime trade and their northern border with China. However North/South tensions is a risk that needs careful attention both in a hot conflict and in the structure of competition.

What Can China offer Vietnam?

The primary challenges facing China in deepening ties with Vietnam are rooted in historical distrust, territorial disputes in the South China Sea, and competition for market share and resources. For China to bring Vietnam closer into its orbit and away from the US, it will need to compromise on it’s ambition. Here we outline potential paths it could consider:

Economic Incentives:

Trade Concessions: Vietnam and China are both part of the RCEP, so China could propose favorable terms or preferential access to its domestic market.

Infrastructure Development: Extend the Belt and Road Initiative (BRI) more comprehensively into Vietnam, financing and aiding in key infrastructure projects. Vietnam is in dire need of infrastructure and utilities upgrades but they will be wary of Chinese influence and do it on their own terms.

Investment: Encourage Chinese companies to invest more heavily in Vietnam.

Technological Collaboration: While Vietnam is wary of Chinese tech, especially in the telecom sector, China could offer partnerships in other tech arenas like green technology. Knowledge transfer agreements where Chinese institutions collaborate with Vietnamese ones, helping to build technological capacity in Vietnam. This would cost Beijing leverage over global manufacturing while Chinese companies learn how to outsource manufacturing. Xiaomi recently opened a factory in Vietnam, but this is a minor investment. We expect that anything that China invests into Vietnam will be non-critical so as not to erode Chinas influence over global manufacturing.

Strategic and Defense Concessions: China could ease its aggressive stance in the South China Sea, recognizing Vietnam's EEZ and reducing military installations and patrols. This would significantly improve trust between the two countries but at a cost of strategic influence for China.

Energy and Natural Resources: Offer partnerships in clean energy development. Mutual recognition of each country's rights to certain rare earth minerals and resources.

Soft-Power: Cultural and people-to-people ties, diplomacy, joint collaboration for regional stability and development, address the trust deficit, open channels for constant dialogue and dispute resolution.

However, the reality is that Vietnam's trajectory, both economically and geopolitically, seems to be tilting towards the US and other like-minded democracies. As such, China's efforts to bring Vietnam closer might face challenges. The situation requires adept diplomacy, mutual respect, and consistent efforts to build trust over time.